Cards Orders Flow

Our card order flow supports both free and paid cards.

You can provide a couponCode if you have one, that will affect the card's price.

Create a new Card

1. Create a Card Order

POST /api/v1/order/create

This endpoint creates a new CardOrder with the status of PENDINGTRANSACTION .

The Card Order is created with the following data:

- A shipping address can be specified by filling the

shippingAddressfield, see endpoint specifications. If not set, the KYC address will be used for shipping. - The total amount to be paid is set in EURe. The amount is 30.23.

- The

couponCodeapplied is taken from theUser.referalCouponCode.

2. (Optional) Attach a Coupon

POST /api/v1/order/{orderId}/attach-coupon

This endpoint attaches a coupon to the CardOrder with orderId.

The coupon needs to be valid else an error is thrown.

We recommend you send the couponCode on the order creation and avoid this step.

3. (Optional) Attach an on-chain transaction

PUT /api/v1/order/{orderId}/attach-transaction

For the card order, a payment must be performed. This endpoint allows setting a transaction hash to the specified orderId.

The transaction can only be used once across all card orders.

Calling this endpoint is optional because the card can be free.

4. Confirm the payment was performed

PUT /api/v1/order/{orderId}/confirm-payment

In order to call this endpoint, the CardOrder.status needs to be PENDINGTRANSACTION .

This endpoint validates if the card order is free. If CardOrder.totalAmountEUR is the same as the CardOrder.totalDiscountEUR then the card is considered free.

Successful Payment Conditions

If the card is not free, we check if a payment was done. The conditions for the payment are:

- Token used for payment needs to be EURe

0xcB444e90D8198415266c6a2724b7900fb12FC56E. - Payment was done to

0x3D4FD6a1A7a1382ae1d62C3DD7247254a0236847. - The respective EURe amount was paid in that transaction hash (partial transfers are not supported).

If the conditions above are met, the CardOrder.status is to READY .

Even if the card is free, this endpoint needs to be called to move the card order to a READY status.

5. Create a Card

POST /api/v1/order/:orderId/card

In order to create a Card out of a CardOrder the following conditions need to be met:

- No cards were created out of this

orderId. - The risk score needs to be Green or Orange.

- User needs to have a verified phone number.

- User needs to have a name set.

- User needs to be from a supported country.

- User address needs to be set.

- User needs to have an approved KYC.

- User needs to have the shipping details for the physical card order set.

- The shipping details can be different from the KYC address, as long as it is in the same country.

- Virtual cards do not require a shipping address.

- The embossed name for the card needs to be set.

In order to create a card, users need to set a pin code. This pin should be sent encrypted, using Paymentology's public key.

Virtual Card Orders

In addition to physical cards, we support virtual card orders. The virtual card order follows the same flow as physical cards, but with these differences:

- No shipping address is required

- The card is available immediately after creation (no shipping delay)

- Virtual cards can be used for online transactions immediately

- No PIN required

1. Create a Virtual Card Order

POST /api/v1/order/create

When creating a virtual card order, you need to specify the cardType as VIRTUAL in the request body:

{

"virtual": true

}

2. Create a Virtual Card

POST /api/v1/order/:orderId/card

Virtual cards are ideal for users who want immediate access to their card for online transactions without waiting for physical delivery. Once Google and Apple Pay are available in the region, the card can be used for in-person transactions too.

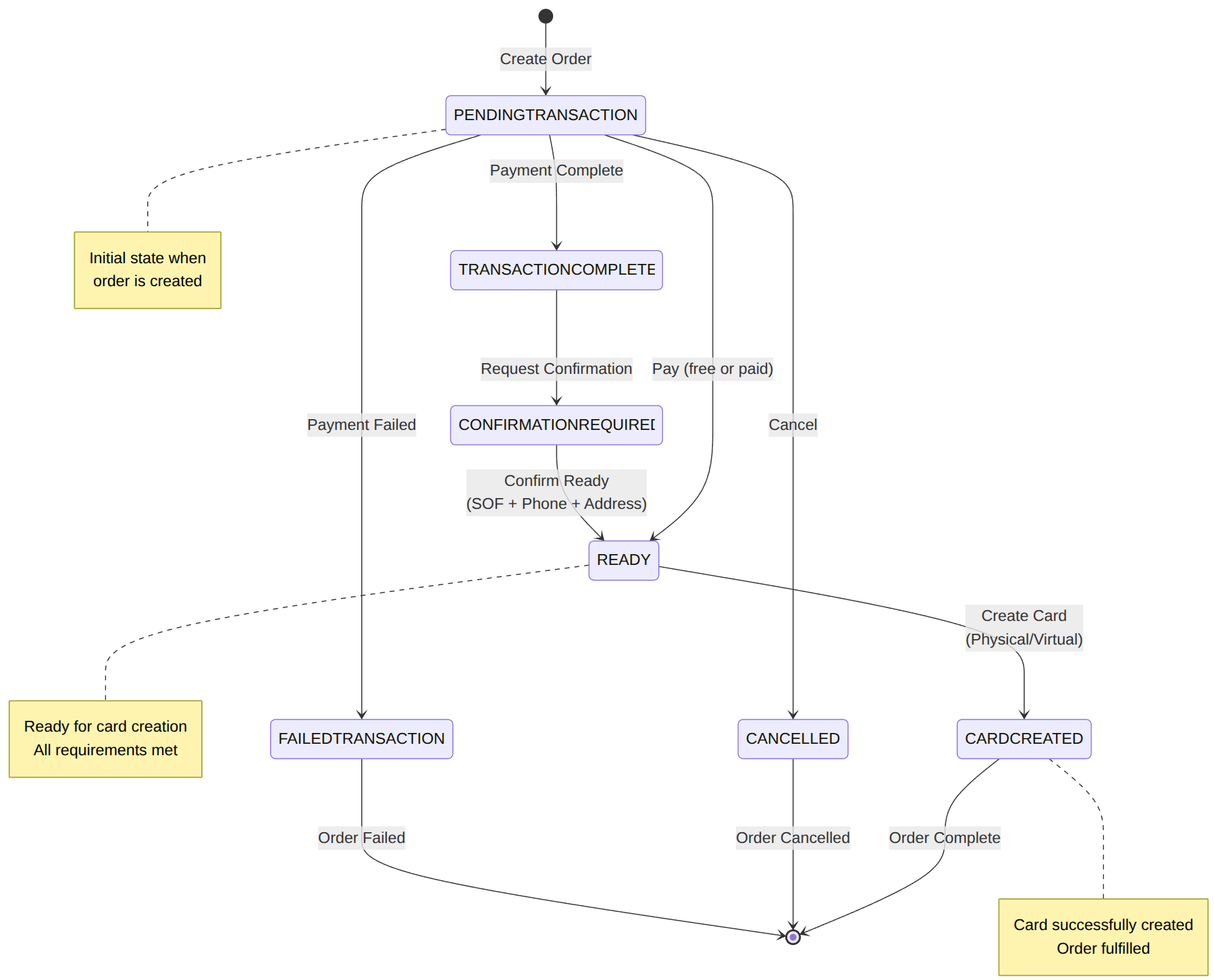

Card Order State Transitions

Understanding the card order state machine is crucial for handling different scenarios in your application. Below is the complete state transition diagram and detailed explanations.

State Transition Diagram

Card Order States

Core States

PENDINGTRANSACTION - Initial State

- Description: Order created, awaiting payment or confirmation

- Next States:

READY,TRANSACTIONCOMPLETE,CANCELLED,FAILEDTRANSACTION - User Actions: Attach transaction, confirm payment, cancel order

TRANSACTIONCOMPLETE - Payment Processed

- Description: Payment transaction completed but requires additional verification

- Next States:

CONFIRMATIONREQUIRED - System Actions: Automatic transition when additional verification needed

CONFIRMATIONREQUIRED - Verification Needed

- Description: Additional user verification required (SOF, phone, address)

- Next States:

READY - Requirements: Phone verified, SOF completed, address provided

READY - Ready for Card Creation

- Description: All requirements met, ready to create physical/virtual card

- Next States:

CARDCREATED - User Actions: Create card with PIN (physical) or without PIN (virtual)

Terminal States

CARDCREATED - Success

- Description: Card successfully created and ready for use

- Next States: None (terminal state)

- Note: Virtual cards are immediately active; physical cards need activation

CANCELLED - Cancelled

- Description: Order cancelled by user or system

- Next States: None (terminal state)

- Note: Only possible from

PENDINGTRANSACTIONstate

FAILEDTRANSACTION - Payment Failed

- Description: Payment processing failed

- Next States: None (terminal state)

- Note: User needs to create a new order

Transition Rules

1. Pay Transition: PENDINGTRANSACTION → READY

Conditions:

- Free card: totalAmountEUR === totalDiscountEUR

- Paid card: Valid EURe payment to correct address

- Transaction hash validation (if required)

2. Request Confirmation: TRANSACTIONCOMPLETE → CONFIRMATIONREQUIRED

Triggered when:

- Additional user verification needed

- System determines extra checks required

3. Confirm Ready: CONFIRMATIONREQUIRED → READY

Requirements:

- User phone verified

- Source of Funds (SOF) completed

- Valid shipping address (for physical cards)

4. Create Card: READY → CARDCREATED

Requirements:

- KYC approved

- Risk score: Green or Orange

- For physical cards: Encrypted PIN required

- For virtual cards: No PIN needed

5. Cancel: PENDINGTRANSACTION → CANCELLED

Conditions:

- Only from

PENDINGTRANSACTIONstate - User-initiated or admin-initiated

Error Handling

When implementing card order handling, consider these scenarios:

Invalid Transitions Will throw TransitionError

- Trying to cancel from READY state

- Attempting to create card from

PENDINGTRANSACTION - Any transition not defined in the state machine

**Common Error Scenarios**

- **Payment Issues**: Transaction hash already used, insufficient payment

- **User Requirements**: Missing KYC, unverified phone, missing address

- **System Issues**: Payment processor errors, card creation failures

### Implementation Example

```javascript

// Check current order state before taking action

const handleOrderAction = async (order, action) => {

switch (order.status) {

case 'PENDINGTRANSACTION':

if (action === 'pay') {

await confirmPayment(order.id);

} else if (action === 'cancel') {

await cancelOrder(order.id);

}

break;

case 'READY':

if (action === 'createCard') {

await createCard(order.id, { setPin: !order.virtual });

}

break;

case 'CARDCREATED':

// Order complete - handle card activation if needed

break;

default:

throw new Error(`Cannot perform ${action} on order with status ${order.status}`);

}

};

Cancellable States

Orders can only be cancelled from specific states. Use the CANCELLABLE_ORDER_STATUSES constant:

// From @gnosispay/prisma/card-order

const CANCELLABLE_ORDER_STATUSES = [

'PENDINGTRANSACTION',

'TRANSACTIONCOMPLETE',

'CONFIRMATIONREQUIRED',

'FAILEDTRANSACTION'

];

Always validate the current order state before attempting transitions. Invalid transitions will throw a TransitionError and return HTTP 422 status code.